Aquafeed Market Size, Share, Growth Opportunities, Trends, Top Companies, and Forecast to 2028

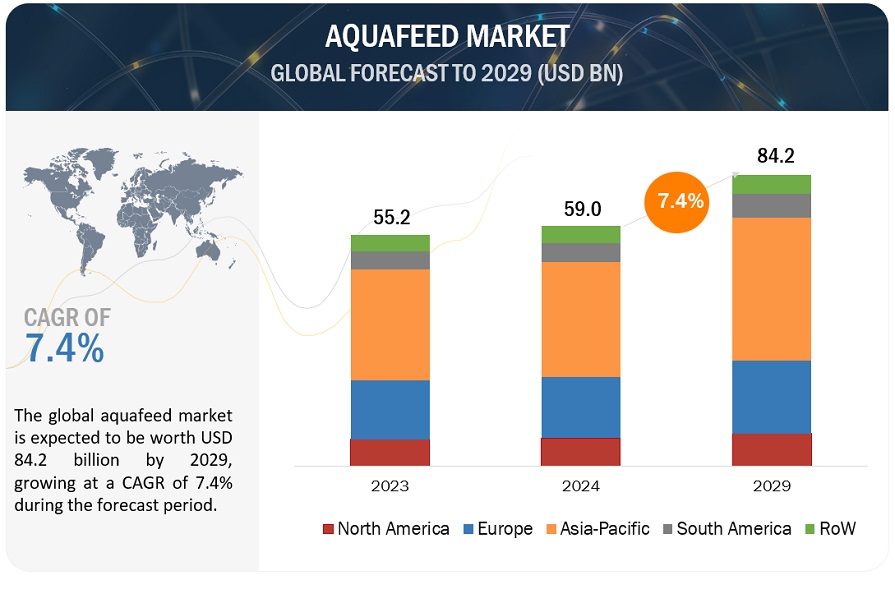

The global aquafeed market is projected to reach USD 88.0 billion by 2028, at a CAGR of 7.3% over the forecast period. It is estimated to be valued USD 61.8 billion in 2023. Several important factors are driving up demand for aquafeed products on a global scale. First, a growing worldwide population has an increased need for seafood, and aquaculture offers a sustainable way to meet this demand. Fish and prawn farming has become more popular because of the depletion of wild fish stocks. Aquafeed is crucial for the healthy growth and development of aquaculture aquatic species, increasing their output and decreasing their reliance on foraging wild fish. Aquafeed products are in high demand to support the expansion of the business since advances in aquaculture technology and practices have made it more effective and financially viable.

The aquafeed market has been experiencing several notable trends driven by various factors such as the increasing demand for seafood, sustainability concerns, technological advancements, and regulatory changes. Here are some key trends shaping the aquafeed market:

Rise in Aquaculture Production: With the global population increasing and wild fish stocks declining, aquaculture has become a significant source of seafood production. This has led to a corresponding increase in the demand for aquafeed to support the growth of farmed fish and other aquatic species.

Shift towards Sustainable Ingredients: There’s a growing emphasis on sustainable and environmentally friendly ingredients in aquafeed formulations. This includes the use of alternative protein sources such as plant proteins, insect meal, single-cell proteins, and even algae. These alternatives reduce reliance on traditional fishmeal and fish oil derived from wild-caught fish, which helps alleviate pressure on marine ecosystems.

Technological Innovations in Feed Production: Advances in feed processing technologies have enabled the production of high-quality aquafeed with improved nutritional profiles and digestibility. Innovations such as extrusion, microencapsulation, and enzyme supplementation enhance feed efficiency and promote better growth performance in farmed fish.

Nutritional Enhancement: Nutritional research continues to drive innovations in aquafeed formulations aimed at optimizing growth rates, feed conversion ratios, and overall health of farmed fish. This includes the development of feed additives such as probiotics, prebiotics, vitamins, and minerals to enhance immune function, gut health, and disease resistance in aquatic species.

Regulatory Changes and Certification: Increasingly stringent regulations and certification standards related to aquafeed ingredients and production processes are shaping the industry landscape. Certification schemes like the Aquaculture Stewardship Council (ASC) and Best Aquaculture Practices (BAP) promote responsible aquaculture practices, including sustainable feed sourcing and quality control.

Market Consolidation and Vertical Integration: The aquafeed industry is witnessing consolidation as larger companies acquire smaller feed producers or form strategic partnerships to expand their market presence. Vertical integration, where feed manufacturers integrate backward into raw material production or forward into aquaculture operations, is becoming more common to ensure supply chain efficiency and quality control.

Growing Demand for Specialty Feeds: As consumer preferences diversify, there’s a rising demand for specialty feeds tailored to specific species, life stages, and production systems. Specialty feeds may include feeds for shrimp, salmon, tilapia, and other species, as well as feeds formulated for hatcheries, nurseries, and recirculating aquaculture systems (RAS).

Digitalization and Data-driven Feed Management: Digital technologies such as IoT sensors, big data analytics, and precision feeding systems are being increasingly adopted to monitor feed quality, feeding behavior, and environmental conditions in aquaculture facilities. Data-driven feed management helps optimize feed utilization, reduce waste, and improve overall farm efficiency.

Aquafeed Market Drivers: Increase in consumption of fish

In recent years, there has been a significant increase in fish consumption worldwide. As people become more health-conscious and aware of the nutritional benefits of fish, it has become a popular choice for many individuals and families. One of the main reasons for the rise in fish consumption is the recognition of fish as a rich source of high-quality protein, omega-3 fatty acids, vitamins, and minerals. These nutrients are essential for maintaining a balanced diet and promoting overall well-being. Moreover, fish is often considered a healthier alternative to red meat due to its lower saturated fat content.

Another contributing factor to the increased demand for fish is the growing awareness of the environmental impact of meat production. As concerns about climate change and sustainability rise, more people are opting for fish as a more environmentally friendly protein source. Compared to land-based livestock farming, fish farming generally has a lower carbon footprint and requires fewer resources such as land and water. Additionally, advancements in technology and transportation have made fish more accessible to a wider range of consumers. Improved cold chain logistics and efficient global trade networks enable the availability of various fish species throughout the year, regardless of geographical location. This accessibility has opened up new culinary experiences and expanded the choices for seafood lovers.

Fishmeal is primarily used in animal diets, particularly for farmed fish. By 2030, it is estimated that 85% of fishmeal will be consumed by the aquaculture sector as feed. China, being the largest producer of aquaculture, will be the largest consumer of fishmeal, accounting for 38% of global fishmeal consumption by 2030. The consumption of fish oil is characterized by competition between the aquaculture industry and dietary supplements for human consumption. By 2030, 66% of fish oil is projected to be used as feed for farmed fish, particularly salmon. The European Union and Norway will remain the main consumers of fish oil, representing 16% and 14% of the world total, respectively, by 2030. Thus the expanding consumption of fish across different applications is a key contributing factor behind the surge in the aquafeed market.

Aquafeed Market Opportunities: Growth in support from governments

The aquaculture industry is growing due to the various initiatives taken by the governments of the respective countries, globally. In India, the Ministry of Agriculture is responsible for the planning, monitoring, and funding of centrally sponsored developmental schemes related to fisheries and aquaculture in all Indian states. It provides an opportunity for the aquaculture industry of India to focus on enhancing the aquaculture sector in the country.

Governments promote aquaculture through education and capacity building initiatives. They offer training programs and workshops to enhance the skills and knowledge of aquaculture farmers, enabling them to adopt best practices and improve productivity. Governments also facilitate the exchange of information and knowledge sharing among industry stakeholders, promoting innovation and collaboration. For instance, The European Union (EU) and the Food and Agriculture Organization (FAO) have been providing support to the Georgian government in the development of the National Aquaculture Development Strategy. The workshop aimed to initiate discussions among various stakeholders involved in aquaculture in Georgia, focusing on extensive aquaculture, mariculture, and fish farming. The objective was to support the formulation of the National Aquaculture Development Strategy of Georgia.

By species, fish segment is projected to have fastest growing rate during the forecast period.

In the aquafeed market, the fish segment is expanding for a variety of reasons. The need for high-quality and nutritionally balanced aquafeed is being driven by the increasing demand for fish protein on a global scale, the depletion of wild fish supplies, and the growth of aquaculture. To ensure optimum development, health, and sustainability in the sector, fish farming, with its well-established practises and different species, needs specialised feeds.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1151

The Asia Pacific region accounted for the largest growing market, in terms of value, of the global aquafeed market in 2028.

Aquaculture thrives in the Asia-Pacific region because of its large coasts, abundance of water resources, and temperate environment. These elements encourage the development and expansion of aquaculture farms, which increases the demand for aquafeed products. The nutritional quality and efficacy of feeds have been improved by advances in aquafeed technology and research, which have increased the growth rates, illness resistance, and overall productivity of aquatic animals raised for food. The demand for aquafeed products is being further fueled by regional aquafeed manufacturers’ increased focus on creating customized feed formulations that address the unique nutritional needs of diverse aquaculture species.

The key players in this include ADM (US), Cargill, Incorporated (US), Ridley Corporation Limited (Australia), Nutreco (Netherlands), Alltech (US), Purina Animal Nutrition (US), Adisseo (Belgium), Aller Aqua A/S (Denmark), Biomin (Austria), Biomar (Denmark), Norel Animal Nutrition (Spain), Avanti Feeds Limited (India), De Heus Animal Nutrition B.V. (Netherlands), Novus International (US), and Biostadt India Limited (India).

ADM (US), Archer Daniels Midland Company (ADM) produces food & beverage ingredients, feed ingredients, industrial ingredients, and biofuels. It operates in about 170 countries and has 70 innovation centers, around 500 crop procurement facilities, and 300 food & feed ingredient manufacturing facilities. It is present in Europe, Asia Pacific, Africa, South America, and North America. The company operates its business through several subsidiaries, such as Golden Peanut Company (US), ADM do Brazil LTDA (Brazil), Wild Flavors (US), and ADM Hamburg AG (Germany). In June 2020, ADM animal nutrition’ aquaculture brand, Ocialis, launched a new brand identity in Asia Pacific region. As part of its long-term strategy to strengthen its industrial and commercial footprint, in addition to consolidating its position as a leading aquaculture player in the Asia Pacific region. In January 2019, ADM acquired Neovia (formerly known as InVivo NSA) (France) for USD 1.82 billion (Euro 1.54 billion). This acquisition would provide a strong platform for ADM’s future growth in aquafeed products with manufacturing more products and catering to its demand.

Cargill, Incorporated (US), Cargill is involved in the manufacturing and marketing of food, agricultural, financial, and industrial products & services. The company’s major business segments include food ingredients & applications; grain origination and oilseed processing; animal nutrition; and risk management and financial services. Cargill’s animal nutrition business offers a range of compound feed, premixes, feed additives, and supply chain & risk management solutions to feed manufacturers, animal producers, and feed retailers around the world. In May 2021, to provide aquaculture producers with news, product information, and events, Cargill established a new web platform called MyEWOS. Aqua farmers may discover current information that highlights the company’s products, services, events, promotions, and news on the website due to its user-friendly and intuitive design.

Browse Related Reports:

About MarketsandMarkets™

MarketsandMarketsTM has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/aquafeeds-market-1151.html